Navigating the World of Investing with Confidence

Investing can be a daunting task for many people, especially those who are new to the world of finance. With so many options and opportunities available, it can be easy to feel overwhelmed and unsure of where to begin. However, with a little knowledge and confidence, navigating the world of investing can be a rewarding experience.

One of the first steps to investing with confidence is to educate yourself about the different types of investments available. From stocks and bonds to real estate and mutual funds, there are a wide variety of options to choose from. By understanding the basics of each type of investment, you can make informed decisions about where to put your money.

Another key aspect of investing with confidence is to set clear financial goals for yourself. Whether you are saving for retirement, a new home, or your child’s education, having a specific goal in mind can help you stay focused and motivated. By knowing what you are investing for, you can make smart decisions that will help you reach your financial goals.

It is also important to have a diversified investment portfolio. Diversification is a strategy that involves spreading your investments across different asset classes and industries. By diversifying your portfolio, you can reduce the risk of losing money if one particular investment performs poorly. This can help you weather market fluctuations and protect your assets over the long term.

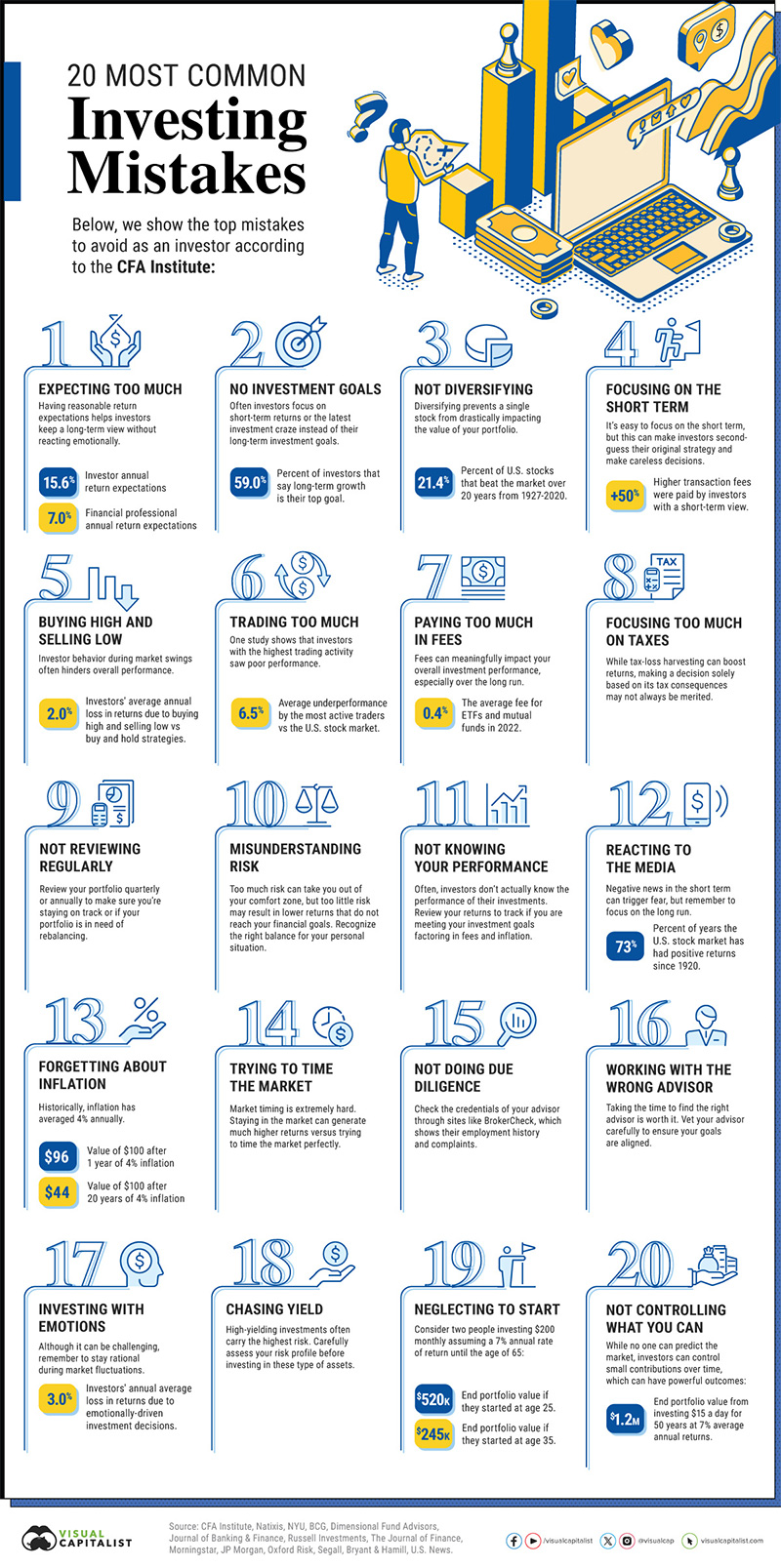

Image Source: besta.com.co

When it comes to navigating the world of investing with confidence, it is also important to evaluate opportunities carefully. Before making any investment, take the time to research the company or fund you are considering. Look at their financial performance, management team, and market position to assess whether it is a good investment opportunity.

In addition to evaluating individual investments, it is also important to consider the overall economic climate and market trends. By staying informed about current events and economic indicators, you can make informed decisions about when to buy or sell investments. Keeping an eye on trends in the market can help you anticipate changes and adjust your investment strategy accordingly.

One common pitfall to avoid when investing is letting emotions dictate your decisions. It can be easy to get caught up in the excitement of a hot investment opportunity or the fear of a market downturn. However, making emotional decisions can lead to impulsive choices that may not be in your best interest. By staying rational and sticking to your investment strategy, you can avoid common pitfalls and make smart decisions that will benefit you in the long run.

Another key to navigating the world of investing with confidence is to seek out advice and guidance from professionals. Whether you work with a financial advisor, attend investment seminars, or read books on investing, learning from experts can help you make informed decisions and avoid common pitfalls. By arming yourself with knowledge and expertise, you can feel more confident in your investment decisions.

In conclusion, navigating the world of investing with confidence requires education, clear goals, diversification, careful evaluation of opportunities, and rational decision-making. By following these tips and avoiding common pitfalls, you can make smart investment choices that will help you reach your financial goals. With the right knowledge and mindset, you can navigate the world of investing with confidence and achieve success in your financial journey.

Maximizing Your Returns: Tips for Smart Investing

When it comes to investing, maximizing your returns is the ultimate goal. Whether you are a seasoned investor or just starting out, there are a few key tips that can help you make the most of your investments while avoiding common pitfalls. By following these tips, you can increase your chances of success and achieve your financial goals.

One of the first things to consider when it comes to smart investing is diversification. By spreading your investments across different asset classes, you can reduce the risk of losing all of your money if one investment performs poorly. Diversification can help you weather market fluctuations and protect your portfolio from unnecessary risk.

Another important tip for smart investing is to do your research. Before making any investment decisions, take the time to thoroughly research the company or asset you are considering. Look at its financials, management team, competitive position, and industry trends. By arming yourself with knowledge, you can make more informed decisions and increase your chances of success.

In addition to research, it is important to have a clear investment strategy. Determine your investment goals, risk tolerance, and time horizon before making any investment decisions. Having a clear strategy in place can help you stay focused and avoid making impulsive decisions based on emotions or market fluctuations.

One common pitfall to avoid when investing is trying to time the market. While it can be tempting to buy and sell investments based on short-term market movements, trying to time the market is a risky strategy that can backfire. Instead, focus on long-term growth and stay invested through market fluctuations.

Another key tip for smart investing is to regularly review and rebalance your portfolio. Over time, your investment mix may drift from your original asset allocation due to market fluctuations. By periodically reviewing your portfolio and rebalancing as needed, you can ensure that your investments remain aligned with your goals and risk tolerance.

One often overlooked aspect of smart investing is the importance of patience. Investing is a long-term endeavor, and it is important to remain patient and stay the course, even when markets are volatile. By staying disciplined and avoiding knee-jerk reactions to market movements, you can increase your chances of long-term success.

Finally, consider seeking the advice of a financial advisor. A professional advisor can help you develop a personalized investment strategy based on your individual goals and risk tolerance. They can also provide valuable insights and guidance to help you navigate the complex world of investing.

In conclusion, maximizing your returns through smart investing requires a combination of research, diversification, strategy, patience, and discipline. By following these tips and avoiding common pitfalls, you can increase your chances of success and achieve your financial goals. Remember to stay informed, stay focused, and stay the course for long-term success in your investment journey.

How to Evaluate Investment Opportunities and Avoid Common Pitfalls