Crafting Your Investment Mix: A Recipe for Success

When it comes to building a diverse investment portfolio, it’s important to approach it like crafting a delicious recipe. Just like a chef combines various ingredients to create a mouth-watering dish, investors should mix different assets to maximize returns and minimize risk. In this article, we will explore how you can create your own investment mix that is tailored to your financial goals and risk tolerance.

First and foremost, it’s essential to understand the importance of diversification in investing. Diversification is like using a variety of spices in a recipe – it adds flavor and depth to your portfolio. By spreading your investments across different asset classes, industries, and geographical regions, you can reduce the impact of market fluctuations on your overall returns. This means that if one part of your portfolio is underperforming, other investments can help balance it out.

One key ingredient in crafting your investment mix is determining your risk tolerance. Just like some people prefer spicy food while others prefer mild, investors have different levels of risk tolerance. If you are someone who is comfortable with taking on more risk for potentially higher returns, you may want to include more stocks in your portfolio. On the other hand, if you are more risk-averse, you may lean towards bonds and other fixed-income securities.

Another important factor to consider when crafting your investment mix is your time horizon. Just like marinating meat overnight can enhance its flavor, staying invested for the long term can help you ride out market volatility and potentially earn higher returns. If you have a longer time horizon, you may be able to take on more risk in your portfolio since you have more time to recover from any downturns.

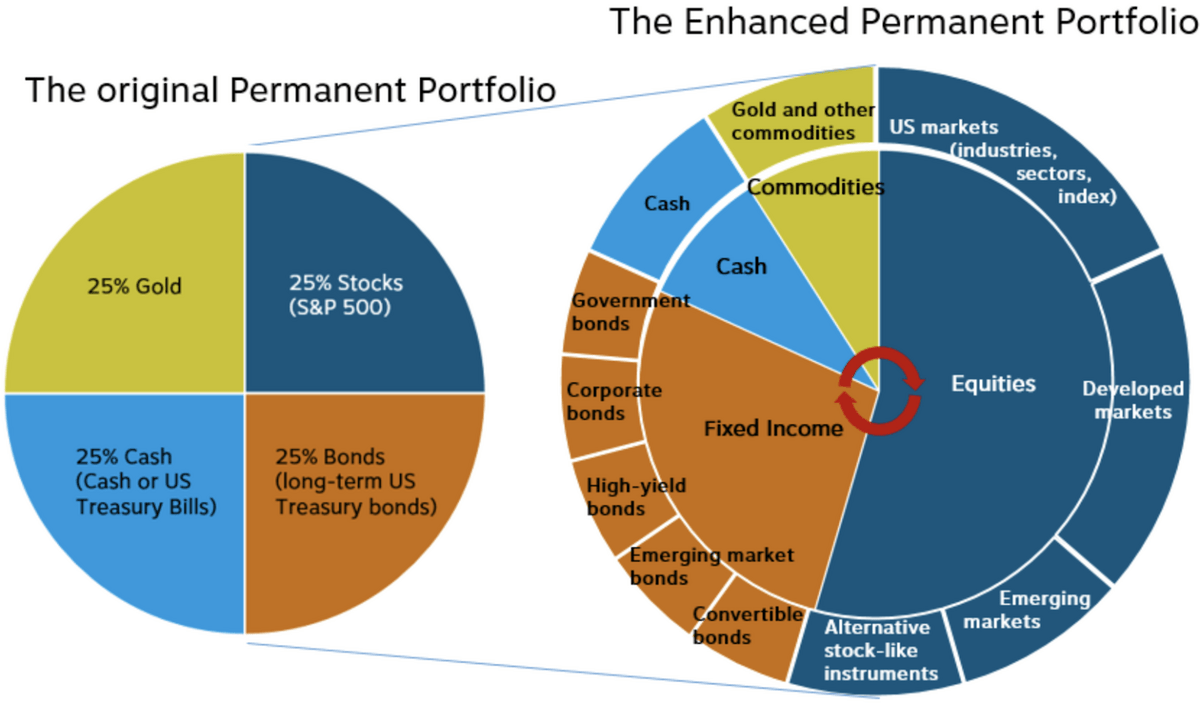

Image Source: wallstreetzen.com

Furthermore, it’s crucial to regularly review and rebalance your investment mix. Just as a chef adjusts seasoning in a dish to taste, investors should periodically review their portfolios to ensure that they are still aligned with their financial goals. Rebalancing involves selling investments that have performed well and buying more of those that have underperformed, maintaining the desired asset allocation.

In addition to traditional stocks and bonds, alternative investments can also be a valuable addition to your investment mix. Just like adding unique ingredients to a recipe can make it stand out, alternative investments such as real estate, commodities, and private equity can provide diversification and potentially higher returns. These assets often have low correlation to traditional investments, making them a valuable addition to a well-rounded portfolio.

Lastly, don’t forget to consider the impact of fees and taxes on your investment mix. Just like the cost of ingredients can affect the overall cost of a dish, high fees can eat into your investment returns over time. Be sure to choose low-cost investments such as index funds and ETFs to keep more of your hard-earned money working for you. Additionally, consider the tax implications of your investments and utilize tax-advantaged accounts whenever possible.

In conclusion, crafting your investment mix is like creating a recipe for financial success. By diversifying across asset classes, understanding your risk tolerance and time horizon, regularly reviewing and rebalancing your portfolio, considering alternative investments, and being mindful of fees and taxes, you can maximize returns and build a strong foundation for your financial future. Just like a well-crafted dish, a well-thought-out investment mix can leave a lasting impression and set you up for long-term success.

Unleashing the Power of Diversification in Your Portfolio

When it comes to building a diverse investment portfolio, one of the most important tools in your arsenal is diversification. Diversification is the practice of spreading your investments across different asset classes, industries, and geographical regions to reduce risk and maximize returns. By not putting all your eggs in one basket, you can protect yourself from market volatility and increase your chances of seeing positive returns.

Diversification is like having a well-balanced diet – you wouldn’t just eat one type of food all the time, would you? Just as you need a variety of nutrients to stay healthy, your investment portfolio needs a variety of assets to thrive. This means investing in a mix of stocks, bonds, real estate, and other assets to ensure that you are not overly exposed to the risks of any one particular market.

One of the key benefits of diversification is that it can help you manage risk. By spreading your investments across different asset classes, you can reduce the impact of any one investment performing poorly. For example, if one sector of the economy experiences a downturn, your diversified portfolio will be better positioned to weather the storm. This can help protect your investments from significant losses and smooth out the ups and downs of the market.

Another advantage of diversification is that it can help you capture opportunities for growth. Different asset classes tend to perform differently in various market conditions. By diversifying your portfolio, you can take advantage of the strengths of each asset class and position yourself to benefit from market trends. For example, while stocks may provide high returns in a bull market, bonds may offer stability during a market downturn. By diversifying, you can create a portfolio that is well-positioned to capitalize on different market environments.

Diversification can also help you achieve a more stable and consistent return on your investments. By spreading your investments across different assets, you can reduce the volatility of your portfolio and create a more predictable pattern of returns. This can help you achieve your financial goals more reliably and avoid the emotional rollercoaster of investing.

To effectively diversify your portfolio, it’s important to consider not only the types of assets you invest in but also how they are correlated with each other. Correlation refers to how closely the returns of two assets move in relation to each other. By investing in assets that are negatively correlated, you can further reduce risk and enhance the diversification of your portfolio. This means that when one asset performs poorly, another may perform well, helping to balance out your overall returns.

In addition to asset allocation and correlation, it’s also important to consider diversification across industries and geographical regions. By investing in a mix of industries, you can protect yourself from sector-specific risks and ensure that your portfolio is not overly reliant on the performance of one particular industry. Similarly, by investing in different geographical regions, you can reduce the impact of regional economic downturns and take advantage of global market opportunities.

In conclusion, diversification is a powerful tool for building a diverse investment portfolio that can help you maximize returns and manage risk. By spreading your investments across different asset classes, industries, and geographical regions, you can create a portfolio that is well-positioned to weather market fluctuations and capture opportunities for growth. So, unleash the power of diversification in your portfolio and watch your investments flourish!

How to Create a Diversified Investment Portfolio for Maximum Returns