Unlocking the Power of Real Estate Crowdfunding

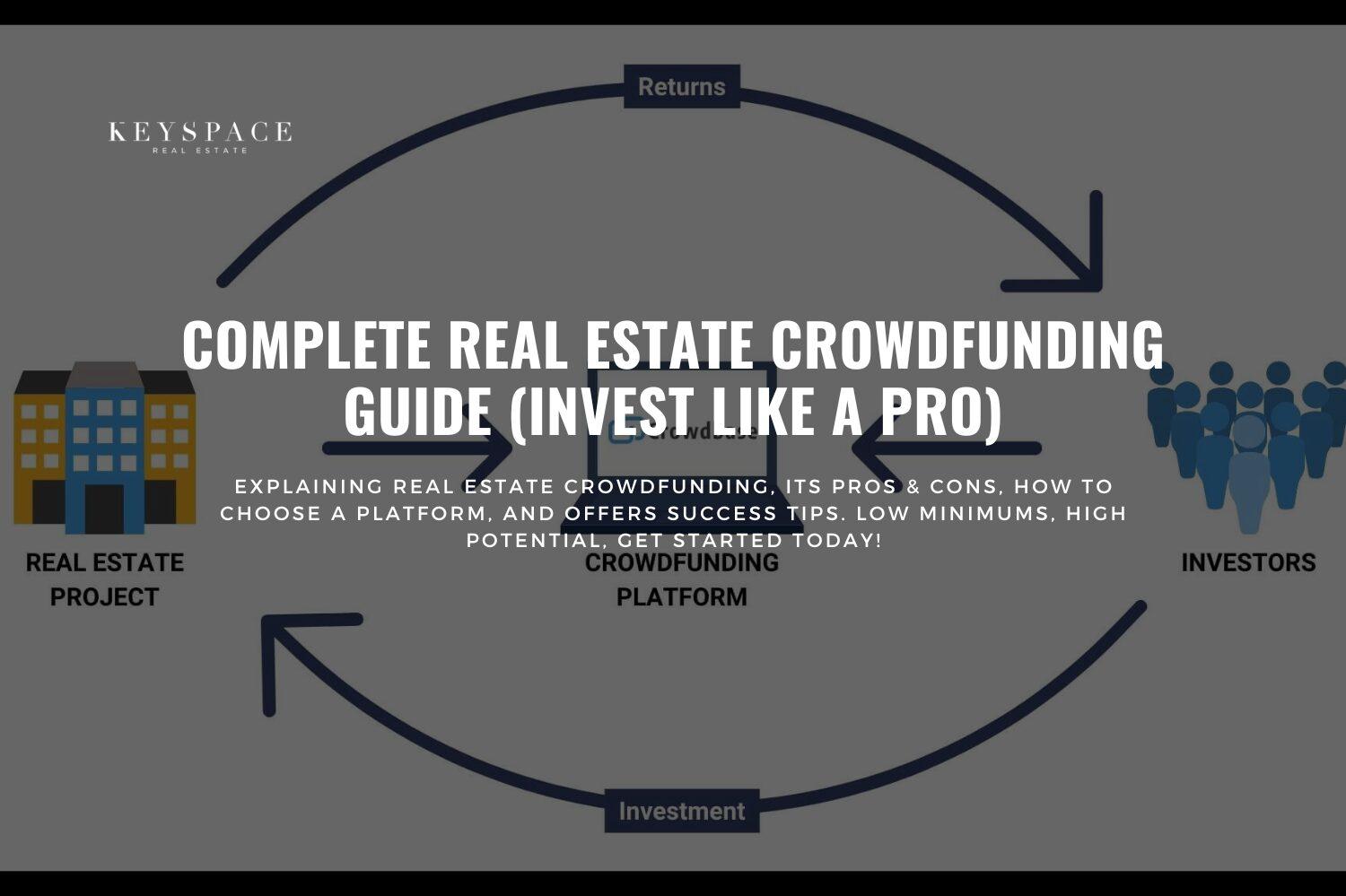

Real estate crowdfunding has revolutionized the way people invest in properties. It has opened up opportunities for individuals to diversify their portfolios and access real estate investments that were previously out of reach. By pooling together resources with other investors, crowdfunding platforms make it possible for everyone to participate in the lucrative world of real estate.

Investing in real estate crowdfunding offers several advantages over traditional real estate investing. One of the biggest benefits is the ability to invest in properties with lower capital requirements. Instead of needing hundreds of thousands of dollars to buy a property outright, investors can now participate in real estate projects with as little as a few hundred dollars.

Furthermore, real estate crowdfunding allows investors to diversify their portfolios easily. By spreading their investments across multiple properties, investors can reduce their risk exposure and potentially increase their returns. This diversification also allows investors to access different types of properties in various locations, further expanding their investment opportunities.

Another advantage of real estate crowdfunding is the accessibility it provides to investors. With online platforms, investors can browse through a wide range of investment opportunities, compare returns, and choose the projects that best fit their investment goals. This level of transparency and accessibility was previously unheard of in the real estate industry, making it easier for individuals to make informed investment decisions.

Image Source: keyspacerealty.com

Additionally, real estate crowdfunding offers investors the opportunity to invest in projects that align with their values and interests. Whether it’s investing in sustainable properties, affordable housing projects, or commercial developments, investors can choose projects that resonate with them and support causes they believe in. This added layer of personalization makes real estate crowdfunding a more fulfilling and engaging investment option.

One of the key aspects of maximizing investment success in real estate crowdfunding is conducting thorough due diligence. Before investing in any project, it’s essential to research the property, the developer, and the crowdfunding platform. Understanding the market dynamics, the potential risks, and the projected returns is crucial in making informed investment decisions.

Furthermore, investors should diversify their investments across different types of properties and locations to reduce risk and increase potential returns. By spreading their investments across multiple projects, investors can protect themselves against market fluctuations and unforeseen events that may impact individual properties.

Another important factor in maximizing investment success in real estate crowdfunding is staying informed about market trends and developments. By staying up-to-date on the latest news and insights in the real estate industry, investors can make timely investment decisions and capitalize on emerging opportunities.

Additionally, building a strong network of professionals and fellow investors can help investors stay informed and connected in the real estate crowdfunding space. By collaborating with others, sharing insights, and learning from experienced investors, individuals can enhance their investment knowledge and potentially uncover new investment opportunities.

Overall, unlocking the power of real estate crowdfunding requires a combination of research, diversification, market knowledge, and networking. By following these strategies and staying informed, investors can maximize their investment success and achieve their financial goals in the exciting world of real estate crowdfunding.

Your Ultimate Guide to Investment Success

Are you looking to maximize your investment success in the world of real estate crowdfunding? Look no further! In this ultimate guide, we will explore the tips and strategies you need to know to make the most of your investments and achieve financial success.

Real estate crowdfunding has revolutionized the way people can invest in properties. Instead of having to buy an entire property on your own, you can now pool your resources with other investors to purchase shares in a property. This allows you to diversify your portfolio and invest in a range of properties without having to commit large sums of money to each individual investment.

So, how can you make the most of this exciting investment opportunity? Here are some key tips to help you achieve investment success in real estate crowdfunding:

1. Do Your Research: Before diving into any investment opportunity, it’s important to do your due diligence. Research the platforms you are considering investing in, as well as the properties themselves. Look at the location, the potential for growth, and the track record of the developers involved.

2. Diversify Your Portfolio: One of the key advantages of real estate crowdfunding is the ability to diversify your portfolio. By investing in a range of properties across different locations and asset classes, you can spread your risk and increase your chances of success.

3. Set Clear Investment Goals: Before making any investments, it’s important to set clear goals for what you want to achieve. Are you looking for short-term gains or long-term growth? Do you want to focus on income generation or capital appreciation? By setting clear goals, you can tailor your investments to meet your specific needs.

4. Stay Informed: The world of real estate crowdfunding is constantly evolving, with new platforms and opportunities emerging all the time. Stay informed about the latest trends and developments in the industry to ensure you are making the most of your investments.

5. Monitor Your Investments: Once you have made your investments, it’s important to monitor them regularly. Keep track of how your investments are performing and be prepared to make adjustments if necessary. By staying proactive, you can ensure that your investments are working hard for you.

6. Seek Professional Advice: If you are new to real estate crowdfunding or unsure about where to start, consider seeking advice from a professional financial advisor. They can help you navigate the complexities of the industry and ensure you are making sound investment decisions.

By following these tips and strategies, you can maximize your investment success in the world of real estate crowdfunding. With careful research, strategic planning, and proactive monitoring, you can achieve financial success and build a strong portfolio of real estate investments. So, what are you waiting for? Start investing and watch your wealth grow!

How to Leverage Real Estate Crowdfunding for Investment Success