Unlock Your Investment Potential with Tactical Asset Allocation!

Are you looking to maximize your returns and achieve financial success? If so, tactical asset allocation may be the key to unlocking your investment potential. This strategy involves actively adjusting the allocation of assets in your portfolio in response to changing market conditions, with the goal of increasing returns and reducing risk.

Tactical asset allocation is all about taking a proactive approach to investing. Instead of simply sticking to a static allocation of assets, investors who employ this strategy continually monitor the market and make adjustments as needed. By doing so, they are able to take advantage of opportunities for growth and protect their investments during market downturns.

One of the main benefits of tactical asset allocation is its flexibility. Unlike traditional buy-and-hold strategies, which require investors to stick to a predetermined allocation of assets regardless of market conditions, tactical asset allocation allows for a more dynamic approach. This can be particularly advantageous in today’s fast-paced and ever-changing financial markets.

Another key advantage of tactical asset allocation is its potential for higher returns. By actively managing the allocation of assets in your portfolio, you can capitalize on market trends and take advantage of opportunities for growth. This can help you achieve greater returns than you might with a passive investment strategy.

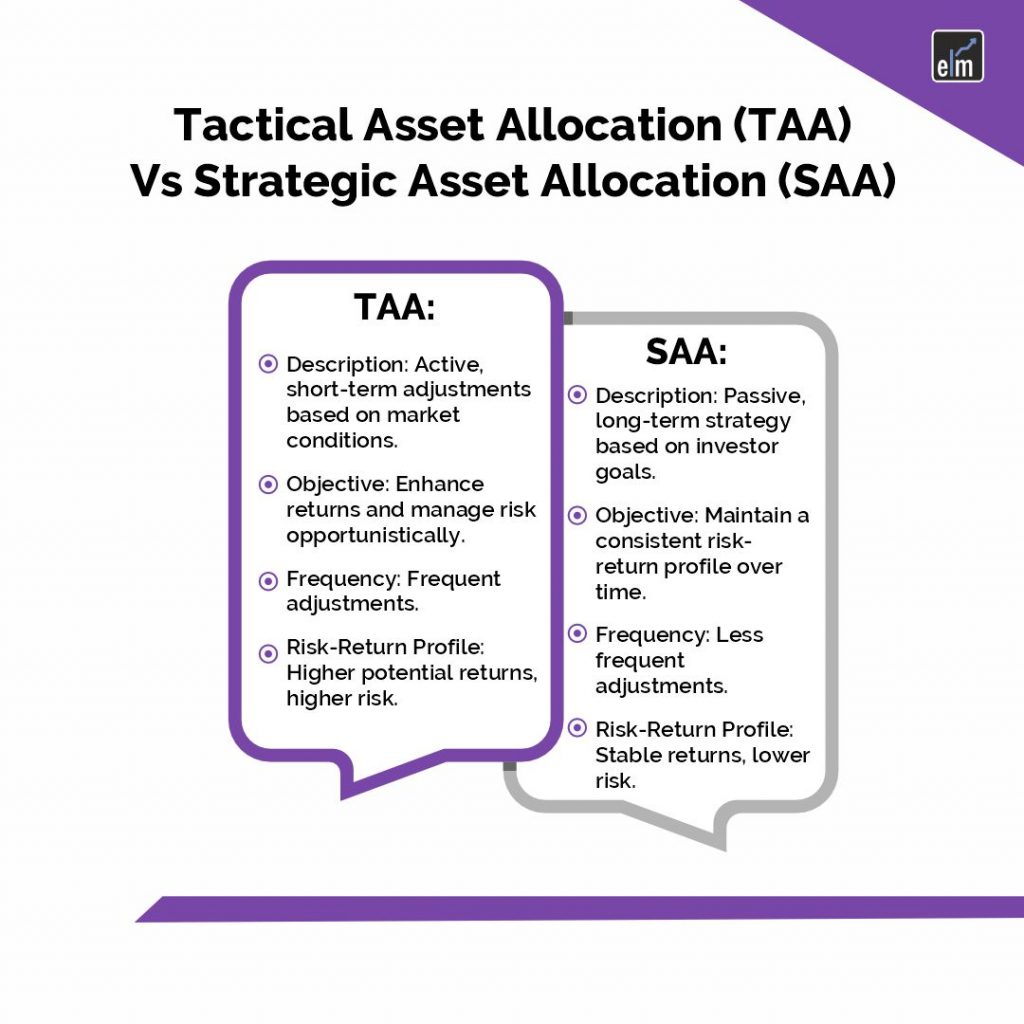

Image Source: elearnmarkets.com

But perhaps the most important benefit of tactical asset allocation is its ability to reduce risk. By actively monitoring the market and adjusting your portfolio as needed, you can help protect your investments from downturns and minimize losses. This can provide you with greater peace of mind and help you achieve your financial goals with confidence.

So how can you start implementing a tactical asset allocation strategy in your own investment portfolio? The first step is to carefully assess your risk tolerance, investment goals, and time horizon. This will help you determine the appropriate allocation of assets for your individual needs.

Next, you’ll need to stay informed about market trends and economic indicators that could impact your investments. By staying up-to-date on the latest news and developments, you can make more informed decisions about when to adjust your asset allocation.

Finally, it’s important to regularly review and reassess your portfolio to ensure that it remains aligned with your investment goals. This may involve rebalancing your assets periodically or making more significant adjustments in response to major market events.

By following these steps and staying proactive in your investment approach, you can unlock your investment potential with tactical asset allocation. This strategy offers the flexibility, potential for higher returns, and risk reduction that can help you achieve financial success and reach your long-term goals. So why wait? Start implementing a tactical asset allocation strategy today and take control of your financial future!

Strategize Your Way to Higher Returns and Financial Success!

In the world of finance and investing, there are countless strategies and techniques that individuals can employ to maximize their returns and achieve financial success. One such strategy that has gained popularity in recent years is tactical asset allocation. This approach involves actively adjusting a portfolio’s asset allocation in response to changing market conditions, with the goal of achieving higher returns and minimizing risk.

Tactical asset allocation differs from traditional buy-and-hold strategies in that it emphasizes flexibility and adaptability. Instead of sticking to a fixed allocation of assets, investors using this strategy will constantly monitor market trends and economic indicators to make informed decisions about when to adjust their portfolio allocations. By doing so, they can take advantage of opportunities for growth and protect their investments during periods of market volatility.

One of the key benefits of tactical asset allocation is its ability to potentially generate higher returns than a passive investment approach. By actively managing asset allocations, investors can capitalize on market inefficiencies and exploit short-term trends that may not be reflected in long-term asset pricing. This can lead to increased returns and improved overall portfolio performance.

Another advantage of tactical asset allocation is its ability to reduce risk and protect against downside losses. By regularly assessing market conditions and adjusting asset allocations accordingly, investors can avoid significant losses during market downturns and preserve capital for future growth opportunities. This dynamic approach to portfolio management can help investors achieve a more balanced and resilient investment portfolio.

To successfully implement a tactical asset allocation strategy, investors must possess a strong understanding of financial markets and economic trends. They must also have the discipline and patience to continuously monitor their portfolio and make timely adjustments as needed. While this approach may require more active involvement than a passive investment strategy, the potential for higher returns and greater financial success can make it a worthwhile endeavor.

In conclusion, tactical asset allocation offers investors a strategic way to maximize returns and achieve financial success. By actively managing asset allocations based on changing market conditions, investors can potentially generate higher returns, reduce risk, and protect their investments from downside losses. While this approach may require more effort and expertise than a passive investment strategy, the potential benefits make it a valuable tool for investors looking to maximize their investment potential.

What Is Tactical Asset Allocation and How Can It Boost Your Returns?